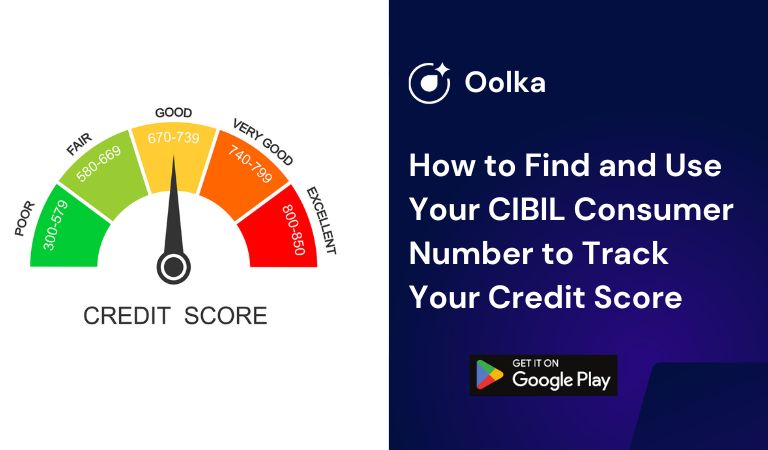

Did you know that your Credit Score plays a major role in ensuring your financial stability? A good Credit Score (usually above 800) on CIBIL helps you secure lower interest rates for loans, quickens credit card approval processes, and gets you higher credit limits too. However, to maintain a high Credit Score, it is also important to assess and check your Credit Score from time to time. This is when your CIBIL Consumer Number comes into the picture. It is a three-digit number that indicates your creditworthiness and serves as a unique identifier to access your detailed CIBIL credit report. To know how you can find your CIBIL Consumer Number easily and use it to track your CIBIL Score, keep reading the post.

What Is a CIBIL Consumer Number?

The CIBIL Consumer Number is a unique identifier linked to your CIBIL credit report. This number is extremely important because it helps you access your credit information while serving as a reference when applying for credit cards and loans. Your CIBIL Consumer Number is easily found on your CIBIL report, which is issued by CIBIL (Credit Information Bureau (India) Limited).

How To Find Your CIBIL Consumer Number?

Finding your CIBIL Consumer Number is not that difficult. Make sure to follow these steps to access your credit information without hassle.

- Step 1: Use your credentials to log into your CIBIL account

- Step 2: Download your credit report

- Step 3: You will be able to find your CIBIL Consumer Number at the top right corner of the report.

If you don’t have a CIBIL account, you can also create one on the CIBIL website. If you don’t remember your login credentials, use the ‘Forgot Password’ section to retrieve your password.

Why Is Your CIBIL Consumer Number Important?

The CIBIL Consumer Number serves as a reference to your credit history. It helps lenders and financial institutions understand your ability to repay debt. Not just that, your CIBIL Consumer Number helps you easily track your CIBIL Score. This is extremely important if you want to resolve any disputes associated with your credit report.

How to Track Your CIBIL Score Using Your Consumer Number?

To track CIBIL score with the help of your CIBIL consumer number, follow these simple steps:

- Visit the CIBIL website or use their mobile app.

- Log in using your consumer number or email ID.

- View your Credit Score and full report. By tracking your score regularly, you can monitor your credit health and spot potential errors in your report that need correction.

What Are The Benefits Of Tracking Your CIBIL Score Regularly?

- Monitoring Credit Health

Regularly checking your Credit Score ensures you stay informed about any changes that could impact your financial standing. Whether it’s a positive boost from timely payments or a dip due to high credit utilization, consistent tracking helps you maintain control. This proactive approach allows you to make informed decisions about your finances.

- Identifying Inaccuracies

Errors in your credit report, such as incorrect account details or unauthorized transactions, can harm your Credit Score. Regular tracking helps you quickly spot and address these discrepancies. Prompt action can prevent these errors from affecting your creditworthiness during critical financial applications.

How Can You Improve Your Credit Score?

- Clear Your Dues

Timely payments on loans and credit card bills show lenders that you are a reliable borrower. Consistent on-time payments are one of the most significant factors in improving your credit score. Delayed payments, on the other hand, can lead to penalties and negatively affect your credit history.

- Avoid Large Expenses

Maintain a low credit utilization ratio to keep your Credit Score healthy: Your credit utilization ratio is the percentage of your credit limit that you use. Keeping it below 30% indicates that you manage your credit responsibly. A high ratio signals financial stress and may lower your Credit Score over time.

- Track Your CIBIL Score

Monitoring your Credit Score allows you to identify inaccuracies, such as incorrect account details or unauthorized activities. Detecting and rectifying these errors promptly can prevent them from damaging your score. Regular tracking ensures your credit report reflects accurate information.

- Limit Loan Applications

Each loan application leads to a hard inquiry on your credit report, which can temporarily lower your Credit Score. Multiple inquiries within a short span may give lenders the impression that you are credit-hungry, reducing your chances of approval. Apply only when necessary to protect your score.

Common Issues with CIBIL Consumer Numbers and Their Solutions

- Forgetting Your Consumer Number

Losing track of your CIBIL Consumer Number can be frustrating, but it’s easy to recover. Simply log in to your CIBIL account using your registered email ID and password, where you can find the Consumer Number in your account dashboard. Alternatively, check your credit report email, as it typically contains the Consumer Number along with other details.

- Citing Incorrect Details in the Report

Errors in your credit report, such as incorrect personal information or unrecognized loan accounts, can negatively affect your Credit Score. If you notice inaccuracies, don’t panic—CIBIL provides a straightforward dispute resolution process. Log in to the CIBIL portal, navigate to the dispute section, and submit a request detailing the error.

FAQs

- Where can I find my CIBIL consumer number?

Your CIBIL consumer number is located at the top right corner of your CIBIL credit report. It’s a unique identifier that you can use to access your credit information. - Can I track my CIBIL Score without the consumer number?

No, you need your CIBIL consumer number or registered email ID to log in to your CIBIL account and track your score. This helps ensure that your credit report is securely accessed. - How often should I check my CIBIL Score?

- Tracking your CIBIL Score once every two to three months is advisable. In fact, you should regularly monitor your credit report to catch any discrepancies and prevent potential issues much ahead.

- What is a good CIBIL score for loan approvals?

A CIBIL Score above 700 is considered ideal by most banks and lending institutions. This number indicates creditworthiness and ability to repay debt. Banks are also likely to offer you lower interest rates once you achieve a higher Credit Score.

Your CIBIL Consumer Number plays a crucial role in helping you access your credit report and track your CIBIL Score. By staying updated on your Credit Score, you will be able to manage your credit health effectively and make timely adjustments to it as well. Regular monitoring will also allow you to spot inaccuracies, avoid financial surprises, and boost your chances of securing loans with favorable terms. So if you want to access a lifetime of financial perks, make sure you log in and track your CIBIL Score starting today!