Startups sometimes face limitations due to cash flow and problems with expense management. In fact, it is really important to…

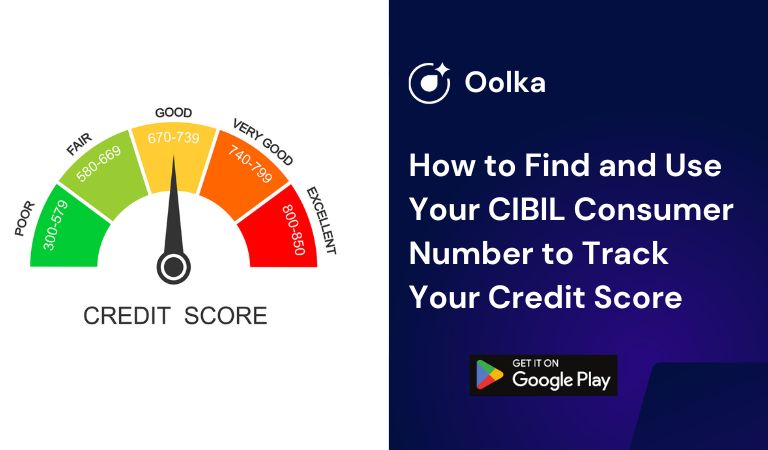

When it comes to determining your credit health, most people look at their CIBIL score. However, there is a lesser-known…

When it comes to maintaining a stable business, nothing is more important than having a strong financial profile. This is…

Getting an urgent loan for a CIBIL defaulter may be a painful experience, but with the right approach, you may…

Did you know that your Credit Score plays a major role in ensuring your financial stability? A good Credit Score…

Credit scores are a reflection of your financial health. All the major banks in India take a good look at…

Banks and financial institutions consider the CIBIL score to be one of the important factors in lending. A CIBIL score…

In today’s age of instant loans and BNPL(Buy Now Pay Later) schemes, there is an urgent need for instant access…

In India, personal loans are distinguished into several categories, based on an individual’s financial needs. Before approving of any loan,…

Your Credit Score demonstrates how you have dealt with credit in the past. Whether you are applying for a loan…